6 Useful Tips for Planning Your Finances as a Digital Nomad

Most digital nomads choose this lifestyle for the freedom it provides. Not being tied down to a place allows you to pursue any career and live your life to the fullest. However, no matter if you’re a freelancer, independent contractor or an employer who prefers remote work, you need to take good care of your finances to be able to maintain your lifestyle. If you’re not so good at budgeting and planning your finances, here are a few tips that will keep you on the road yet allow you to enjoy all the comforts and financial safety you need.

Cover your bases at home

Some digital nomads choose to stay on the road full-time, others spend a part of their time at home. If you’re a homeowner or you’re renting, you need to consider all the expenses of maintenance—this will definitely affect your budget.

Let’s say you’re gone for six months of the year and staying home for the rest of the time. Do you have the opportunity to list your home as an Airbnb? If that’s not an option, you must ensure your budget allows you to pay mortgage or rent and keep up with the utility bills, taxes and insurance.

Manage your budget

If you want to stay on the budget, you should consider getting rid of various recurring charges you don’t need on the road. For instance, you might want to give up take-out meals, cancel your gym memberships and stop indulging in overly expensive weekend trips. If you love adventure, it’s best to opt for a road trip adventure than a lux outing—it’s more fun and less straining on your wallet.

Ensure quick access to your money

Living in a foreign country or traveling around the globe regularly will require you to have quick and easy access to your money. The easiest way for digital nomads to pay for expenses is to use a credit card that doesn’t involve any foreign transaction fees, so you can just pay the balance in full every month. Frequent movers might also consider grabbing a practical free luggage credit card to receive a quality piece of luggage. This will come in more than handy during their trip. Those who prefer a debit card should consider opening an account with a global bank that has many branches and ATMs around the world.

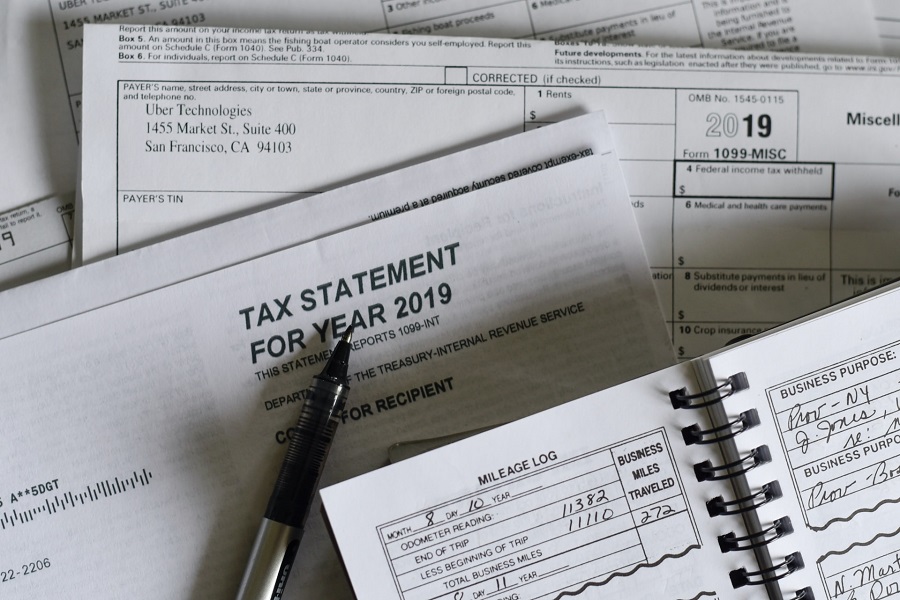

Think about taxes

Working on the road doesn’t mean you’re exempt from paying taxes. No matter if you’re working abroad full-time or if you’re spending part of the year at home, your income will still be taxed. You also must pay income tax and quarterly taxes if you’re self-employed. For some people like the U.S. citizens, this might be a little tricky, since you have to file taxes even if you don’t owe. If you spend 11 months of the year outside the U.S. you can apply for Foreign Earned Income Exclusion credit though. Usually, taxes greatly depend on your situation and you will need to do some research on your own, but most people manage to file their taxes online and keep everything in order without too many issues. most user-friendly invoice template.

Don’t forget about your retirement plan

Most digital nomads concentrate on having an emergency fund, but you also need to think about your retirement. Freelancers, independent contractors and business owners can’t rely on an employer’s 401(k), so you’ll need to find a way to save for retirement on your own.

Revisit your budget and see how much money you can set aside for retirement every month and commit to that number regularly. The easiest way to grow your retirement wealth is to automate your contributions. Every year, make sure to review your investment choices to ensure they fit your budget, goals and risk tolerance. If you’re paying fees for individual investments, review them regularly to ensure your account’s earning potential is maximized.

Improve your income

Your current job might be paying well, but long-term, it’s good to have a source of passive income which will put money in your pocket with minimal to zero effort. This might include everything from selling products and offering courses to having rental properties. You can find various useful articles on how to improve your passive income stream online, so do your research.

Once you get your finances in check, you can start enjoying all the freedom digital nomad lifestyle has to offer. Stay true to your budget and get ready to work and explore the world!