Explode Your Profits Using These Tips To Find An Online Forex Broker

Planning on starting forex trading? The first thing you have to do is to find a forex broker and open a personal or corporate account. A forex broker is a company that offers traders a platform where to buy and sell foreign currencies (FX). So, the forex broker is your connection to the market and offers essential cover to trade with margins. With presence of many forex brokers online, due diligence is necessary to ensure that you pick one who will help explode your profits.

Tips to find a great online forex broker

Dependability

The ideal forex broker is trustworthy and won’t vanish with your hard-earned money. It is important to note that the FX doesn’t have regulations creating room for existing of dishonest ones. The fit step to check reliability of the broker is to ensure they are registered by the Financial Conduct Authority in United Kingdom.

Equally important is to check reviews and testimonials about the company. Happy customers never hesitate to say good things about a company. So, a forex broker with a lot of positive reviews gives peace of mind that you’re dealing with a reliable and genuine broker. Not to forget, the broker should always be online. A forex trading platform that goes offline is likely to make you lose out on opening or closing a trade at an opportune moment.

Services offered

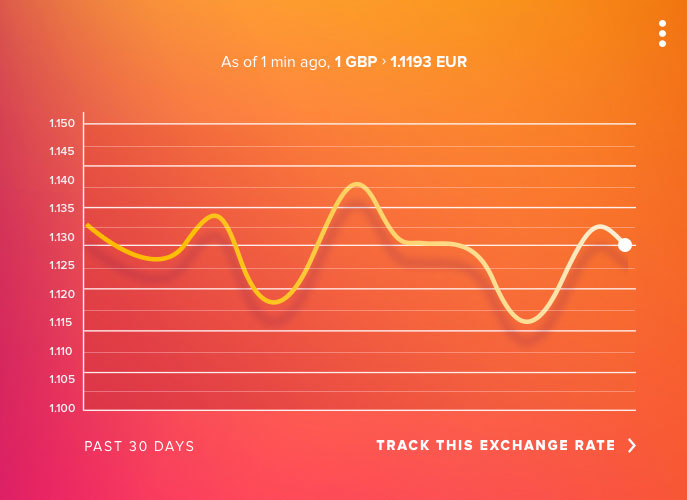

The FX market works 24 hours 7 days a week. So, when choosing an online FX broker in UK, be sure to find out whether the platform is available all the time. The ideal trader is always available while offering round-the-clock support all the time. Besides, the trading platform should cover the main currencies in the world including US Dollar, UK Pound, Japanese Yen, Canadian Dollar, Euro, and Australian Dollar. The broker should also offer other extras such as real time exchange rates and an app that works on all smartphone platforms.

Broker costs

The difference between FX brokers and other business models is that these don’t make a commission to customers. Brokers make income from the difference in trading spread. This is the difference between buying and selling prices of a currency pair. The FX trading spread depends on the broker’s terms of service and currency pair trading at the moment.

Be mindful of brokers with special offers on lower trading spread that might not last after you have committed your hard earned money. Equally important is to consider the minimum amount of capital investment when opening an account. The rule of thumb is to start small until you gain more knowledge then you increase the investment.

Lot size

This has various names including trade size and size of trade. It varies by broker with 100,000 trading units of a currency considered as the standard lot. A mini lot has 10,000 trading units and a micro lot has 1,000 trading units. Keep in mind that tome brokers offer fractions of a lot to give you a chance to set the lot size you can afford. Depending on your view, this can be a bonus or a complication to the trading process.

Customer service

The FX broker to deal with should offer helpful and efficient assistance whenever you need it such as during account opening. Ensure that the broker has a proven track record of offering exceptional customer service without leaving you to deal with a chat bot or automated emails. You can tell the company’s customer service quality from reviews and testimonials. Additionally, the broker’s chat box or email on the website doesn’t take long to send replies.

Security of personal details

The security of your personal information is very important when sharing it online. So, ensure to pick an FX broker with security protocols in place to protect your privacy. The broker should have advanced security measures in place including Secure Socket Layer (SSL) 128-bit encryption to limit authorized use of customer’s credit cards.

Exit strategy

Lastly, time comes when you have made enough profits and want to withdraw your money. This should be quick an easy. The FX broker should make it possible to receive your money in a few days. Some insist on having to wait for 14 days which is quite unnecessary. The whole process of closing your account should be as simple as calling the company and requesting for termination of your account.

After filling the termination of account form with all your details, the company representative might as why you’re closing it. Be honest enough here and the representative is likely to try to convince you to keep the account. Whether you close it or keep it is up to you at this moment but the whole process should not be prohibitive in any way.

Wrapping up

Trading in forex is a good business model that transcends geographical boundaries. You have to find a reputable FX broker and get an account. However, due diligence is paramount to ensure that you work with a company that will help you explode your profits.